Effective expense management is fundamental for every business, helping track spending, control budgets & make informed financial decisions. However, managing expenses manually often leads to inefficiencies and inaccuracies, especially when data is spread across multiple systems and departments. This fragmented approach can cause delays, errors & a lack of visibility, ultimately impacting overall financial reporting.

Accurate financial reporting requires a comprehensive view of all expenses. By streamlining expense management with solutions like Zaggle’s Standard Accounting Extraction Template, businesses can ensure that financial data is seamlessly captured, consistent & ready for reporting. This not only enhances efficiency but also improves the accuracy and timelines of financial statements, making compliance and strategic decision-making more manageable.

The Problem with Manual Financial Data Extraction:

Manual financial data extraction often results in:

- Time-Consuming Processes: Extracting and preparing financial data manually can delay the financial reporting cycle.

- Inconsistent Data: Human errors can introduce discrepancies, leading to inaccurate financial statements and jeopardizing financial data accuracy.

- Increased Compliance Risks: Manual processes make it harder to adhere to financial and accounting systems regulations and standards.

- Operational Inefficiency: The resources required for manual tasks could be better utilized for automated financial reporting and analysis.

These challenges highlight the need for automated accounting solutions that ensure streamlined reporting and more reliable financial data.

The Role of Standardization in Financial Reporting:

Standardization plays a key role in simplifying the reporting process. By using a Standard Accounting Extraction Template, businesses ensure consistency in their financial data and minimize the risk of errors.

Key Benefits of Standardization:

Uniform Data Formats: Financial Data is consistently formatted, ensuring clear and accurate reporting.

Automated Extraction: Reduces manual effort and accelerates the reporting process, enabling faster automated financial reporting.

Error Minimization: A standardized approach reduces human error, ensuring that financial data accuracy is maintained.

Simplified Audits: With standardized data, preparing for audits becomes easier and faster, improving the efficiency of the audit process.

How Zaggle Simplifies Financial Reporting

Zaggle’s Standard Accounting Extraction Template combines standardized practices and automated accounting solutions to tackle the challenges of financial reporting.

Key Features:

- Efficient Data Extraction: Integrates directly with financial and accounting systems to automate data extraction.

- Error-Free Reports: Ensures that financial statements are free of errors, enhancing financial data accuracy.

- Compliance-Ready: Meets the necessary regulatory requirements for financial reporting.

- Adaptable Framework: Can be customized to meet specific industry needs and unique reporting structures.

Use Cases and Applications:

Zaggle’s Standard Accounting Extraction Template can be beneficial for:

CFOs and Financial Controllers:

- Streamlining monthly, quarterly & annual financial closing processes.

- Ensuring timely and accurate financial reporting that supports data-driven decisions.

- Maintaining compliance with evolving financial regulations.

Accounting Teams and Auditors:

- Automating data extraction reduces the time spent on manual preparation.

- Provides audit-ready financial data, improving the efficiency of audit processes.

- Reduces human error, thereby improving the integrity of financial data.

Benefits for Organizations

By leveraging a standard accounting extract template, businesses gain the following benefits:

- Increased Efficiency: Automated data extraction reduces time spent on manual tasks.

- Improved Accuracy: Ensures financial data is precise and compliant with regulations.

- Resource Optimization: Teams can focus on strategic analysis, rather than data extraction.

- Regulatory Compliance: Supports adherence to financial regulations, ensuring companies meet industry standards.

- Audit-Ready Financial Data: Prepared and validated data facilitates faster, more efficient audits.

Efficiency Comparison: Manual vs. Automated Extraction

| Feature | Manual Extraction | Automated Extraction (Zaggle) |

| Data Entry | Manual input, error-prone | Auto-extracted from EMS |

| Compliance | Requires manual checks | Enforces compliance rules |

| Time Taken | Hours/days | Minutes |

| Audit Readiness | Unstructured data, delays | Standardized, real-time access |

Configurable Options

Admins can define specific permissions for different personas when extracting data, based on company policies. This ensures greater control and security over financial information.

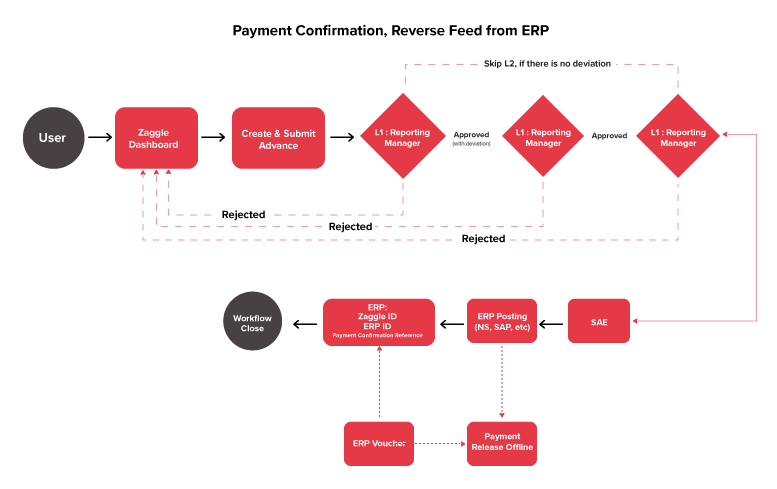

Streamlined Data Flow: From EMS to Financial Systems

Efficient financial data extraction isn’t just about automation – it’s about seamless integration across platforms. The Standard Accounting Extraction Template in Zaggle’s Expense Management Solution ensures that data flows effortlessly to the financial systems, aligning with your company’s existing workflows.

The accompanying diagram illustrates this smooth data transfer process, showing how:

This integrated approach reduces manual interventions, ensuring accurate and timely financial data for reporting, compliance and audits.

Conclusion

The complexities of financial reporting make it essential for organizations to adopt automated accounting solutions like Zaggle’s Standard Accounting Extraction Template. It not only simplifies data extraction but also ensures accuracy and compliance with industry standards, helping businesses to meet their financial and regulatory goals.

By transitioning to automated financial reporting, businesses can optimize their financial operations, reduce errors & focus on strategic growth while maintaining strong compliance.